€500 Million Tvi: The Importance Of Due Diligence And Investor Caution

Editor's Notes: "€500 Million Tvi: The Importance Of Due Diligence And Investor Caution" have published today date to put a light on a very important topic of Tvi. Recently happened incident of near €500 Million Tvi made us to think about the importance of Due diligence and Investor Caution. So that our target audience can learn a lesson from it and make the right decision at the right time.

After doing some analysis, digging information, made €500 Million Tvi: The Importance Of Due Diligence And Investor Caution we put together this €500 Million Tvi: The Importance Of Due Diligence And Investor Caution guide to help target audience make the right decision.

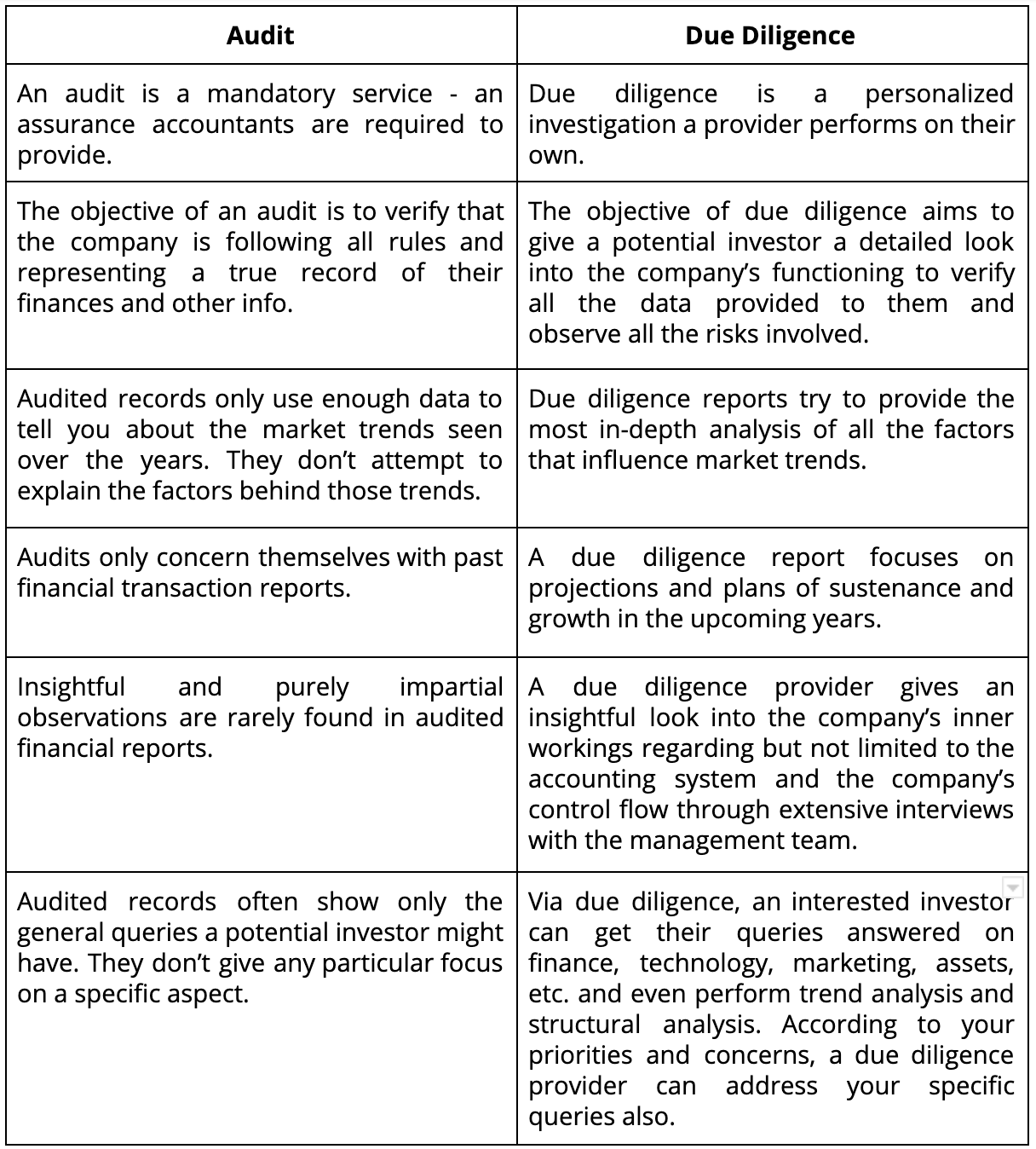

| Due diligence | Investor caution | |

|---|---|---|

| Definition | The process of investigating a potential investment to assess its risks and opportunities. | The act of being careful and cautious when investing money. |

| Importance | Due diligence can help investors make informed decisions about whether to invest in a particular opportunity. | Investor caution can help investors avoid losing money on bad investments. |

| Benefits | Due diligence can help investors:

|

Investor caution can help investors:

|

Transition to main article topics

The main article topics will cover the following areas:

- The importance of due diligence

- The importance of investor caution

- How to conduct due diligence

- How to avoid scams

- Resources for investors

FAQ

This section provides answers to frequently asked questions (FAQs) regarding the €500 Million Tvi fraud case, emphasizing the importance of due diligence and investor caution.

FREE Due Diligence Checklist Templates - Download in Word, Google Docs - Source www.template.net

Question 1: What is the significance of due diligence in investing?

Due diligence is crucial as it involves conducting thorough research and analysis before making an investment decision. It includes evaluating the company's financial health, management, industry, and market conditions. By performing due diligence, investors can mitigate risks and make informed decisions to safeguard their investments.

Question 2: What are the red flags that investors should watch out for when investing?

Investors should be wary of unrealistic returns, complex investment structures, lack of transparency, and pressure to invest quickly. Additionally, they should be cautious of investments that promise guaranteed returns or minimal risk, as these claims often indicate a potential scam.

Question 3: How can investors protect themselves from fraudulent investment schemes?

To protect themselves, investors should conduct thorough due diligence, consult with a financial advisor, and be skeptical of any investment opportunities that appear too good to be true. They should also avoid investing in companies or schemes that are not regulated or licensed by reputable authorities.

Question 4: What are the consequences of investing in fraudulent schemes?

Investing in fraudulent schemes can result in significant financial losses, emotional distress, and legal implications. Victims may find it challenging to recover their investments and may face difficulties in obtaining compensation.

Question 5: What lessons can be learned from the €500 Million Tvi fraud case?

The Tvi fraud case highlights the importance of due diligence, investor education, and the need for robust regulatory frameworks to prevent such schemes from operating. It also emphasizes the consequences of investing without proper research and the responsibility of investors to protect their own financial interests.

Question 6: What actions should investors consider taking to enhance their financial literacy and protect themselves from fraud?

Investors should engage in financial education, attend workshops and seminars, and consult with financial professionals to improve their understanding of investment principles and risk management. They should also stay informed about financial scams and fraudulent practices to safeguard their assets.

By heeding these guidelines, investors can make more informed decisions, safeguard their investments, and protect themselves from the detrimental effects of fraudulent investment schemes.

For more information, please refer to the following article:

Tips

The situation of €500 Million Tvi: The Importance Of Due Diligence And Investor Caution highlights the importance of due diligence for investors. Before making any financial decisions, it is essential to thoroughly research the company, its operations, and its financial health. This can help avoid substantial losses. Here are some tips to consider when making investment decisions:

Tip 1: Conduct Thorough Research

Understand the company's business model, industry position, and financial performance. Review its financial statements, annual reports, and any other relevant documents.

Tip 2: Seek Professional Advice

Consult with a financial advisor or attorney to gain an objective perspective on the investment. They can provide insights and guidance based on your financial goals and risk tolerance.

Tip 3: Verify Claims and Promises

Be cautious of unrealistic returns or promises. Verify any claims made by the company through credible sources and independent research.

Tip 4: Understand the Risks

Recognize that all investments carry some level of risk. Assess your risk tolerance and align your investments accordingly.

Tip 5: Monitor Investments Regularly

Keep track of your investments' performance and be prepared to adjust your strategy if necessary. Regularly review financial statements and market updates.

Tip 6: Avoid Emotional Decisions

Make investment decisions based on rational analysis, not emotions or hype. Avoid being influenced by market noise or fear of missing out.

Tip 7: Protect Against Fraud

Be aware of common investment scams. Research potential investments thoroughly and avoid dealing with unlicensed or unregistered entities.

Summary

Due diligence is a crucial step in protecting your financial well-being. By following these tips, you can make informed investment decisions and minimize the risk of losses.

€500 Million Tvi: The Importance Of Due Diligence And Investor Caution

Due Diligence: What is Due Diligence,Types,Procedure and Checklist - Source www.deskera.com

The 2011 collapse of Tvi, a Portuguese investment scheme that defrauded investors of over €500 million, underscores the paramount importance of due diligence and investor caution in the financial markets.

- Thorough Research: Conduct comprehensive research on investment opportunities, including background checks on companies and individuals involved.

- Independent Verification: Seek independent confirmation of financial statements and claims made by investment firms.

- Understanding Risks: Fully comprehend the risks associated with any investment, as high returns often come with higher levels of risk.

- Professional Advice: Consult with a qualified financial advisor or lawyer for guidance and professional insights.

- Regulatory Oversight: Check if the investment firm is regulated by reputable authorities and adheres to industry standards.

- Past Performance: Examine the historical performance of investment schemes and individuals to assess their track record and consistency.

Tvi investors overlooked these aspects, lured by promises of unrealistic returns. By disregarding due diligence, they fell victim to a fraudulent scheme that could have been avoided through informed decision-making and healthy skepticism.

Importance of Due Diligence for Third Parties - Freedom Consulting LLC - Source www.fc-llc.org

€500 Million Tvi: The Importance Of Due Diligence And Investor Caution

The collapse of Tvi, a Portuguese investment company, in 2007 with €500 million in lost investor funds, serves as a cautionary tale highlighting the critical importance of due diligence and investor vigilance. Tvi's fraudulent scheme, which promised unrealistic returns, lured unsuspecting investors into a Ponzi scheme that ultimately crumbled, leaving a trail of financial devastation.

Due diligence, the process of thoroughly investigating an investment opportunity before committing funds, is essential for identifying and mitigating risks. It involves scrutinizing the company's financial statements, market position, management team, and regulatory compliance. By conducting thorough due diligence, investors can uncover red flags that may indicate fraud or financial instability, allowing them to make informed decisions and safeguard their investments.

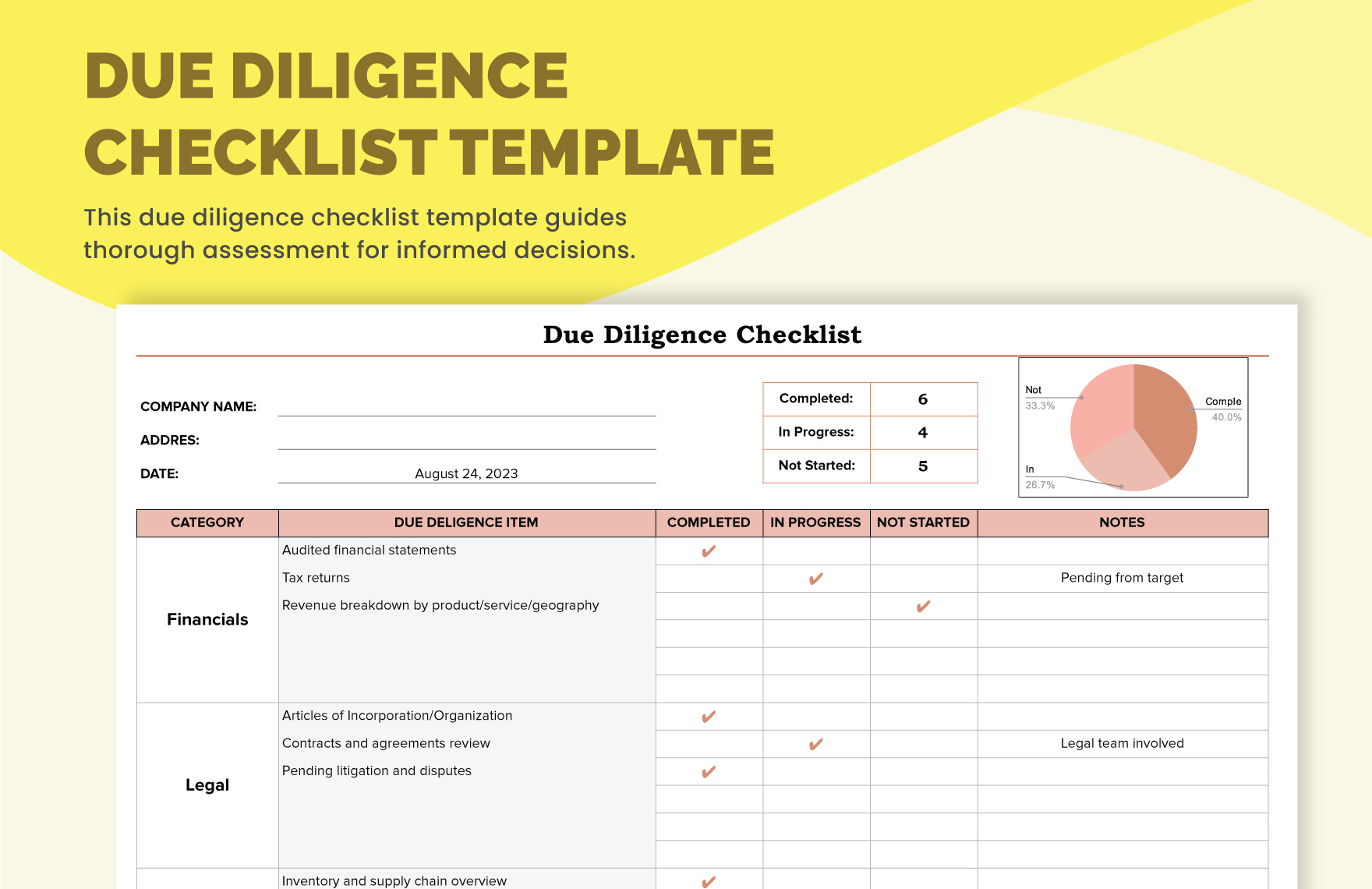

Due Diligence Checklist Template - Download in Excel, Google Sheets - Source www.template.net

Investor caution is equally crucial. Resisting the temptation of quick and easy returns, investors should approach investment opportunities with skepticism and seek independent financial advice. Thorough research and a clear understanding of the risks involved are essential before committing funds. The Tvi case demonstrates how greed and a lack of due diligence can lead to severe financial losses.

Regulators also play a vital role in protecting investors. They can implement stronger regulations, enforce existing laws, and provide investor education to raise awareness of financial scams. By working together, investors, financial advisors, and regulators can create a more secure investment environment that minimizes the risk of such catastrophic losses in the future.

Conclusion

The collapse of Tvi underscores the paramount importance of due diligence and investor caution in the world of investments. By conducting thorough investigations and exercising vigilance, investors can protect themselves from fraudulent schemes and safeguard their financial well-being. Regulators must also remain vigilant and proactive in enforcing regulations and educating investors to prevent similar disasters in the future. Only through a concerted effort can we foster a secure investment environment that fosters growth and protects investor interests.

The Tvi case serves as a stark reminder that "if something seems too good to be true, it probably is." Investors must approach investment opportunities with skepticism and seek professional advice when necessary. By embracing due diligence and caution, we can empower ourselves to make informed financial decisions and avoid becoming victims of financial fraud.