Facturi Ciolacu has revolutionized the electronic invoicing landscape in Romania!

Editor's Notes: Facturi Ciolacu: Decoding The Electronic Invoicing System In Romania was published on (date).

This topic is important because it provides insights into the electronic invoicing system in Romania, including its benefits and how it works.

After thorough analysis and research, we've compiled this comprehensive guide to help you understand Facturi Ciolacu and make informed decisions.

Key Differences or Key Takeaways:

| Feature | Facturi Ciolacu |

|---|---|

| Electronic Invoicing System | Yes |

| Compliant with Romanian Law | Yes |

| Easy to Use Interface | Yes |

| Secure and Reliable | Yes |

... (continue with the main article topics)

FAQ

This FAQ section provides comprehensive answers to frequently asked questions regarding Romania's electronic invoicing system, Facturi Ciolacu. It aims to clarify any misconceptions or concerns and empower users with a deeper understanding of the system.

Question 1: When is the deadline for transitioning to electronic invoicing in Romania?

As of January 1st, 2023, all companies in Romania are required to issue electronic invoices.

Question 2: What are the benefits of using Facturi Ciolacu?

Facturi Ciolacu offers numerous benefits, including reduced costs, improved efficiency, and enhanced security.

Question 3: Is it mandatory to use Facturi Ciolacu?

Yes, all companies in Romania are obligated to use Facturi Ciolacu for issuing electronic invoices.

Question 4: What types of businesses are exempt from using Facturi Ciolacu?

Businesses with a turnover below 100,000 lei per year are exempt from using Facturi Ciolacu.

Question 5: How do I register for Facturi Ciolacu?

Registration for Facturi Ciolacu can be completed online through the official website.

Question 6: What are the penalties for non-compliance?

Companies that fail to comply with the electronic invoicing regulations may face fines.

In conclusion, Facturi Ciolacu is a comprehensive electronic invoicing system that offers numerous benefits for businesses in Romania. By leveraging this system effectively, companies can streamline their invoicing processes, save costs, and enhance their overall efficiency.

Tips for Utilizing Electronic Invoicing in Romania

In line with the directive from the EU, Romania has implemented an electronic invoicing system to streamline business processes and enhance transparency. Understanding the intricacies of this system can empower businesses to reap its benefits effectively. Here are some key tips to decode the electronic invoicing system in Romania:

Electronic Invoicing System (EIS BIR) Implementation - Source www.qne.com.ph

Tip 1: Obtain Digital Certificates

To issue and receive electronic invoices, businesses must possess valid digital certificates. These certificates serve as a digital signature, ensuring the authenticity and integrity of invoices.

Tip 2: Register with the National Invoice Registry

Businesses operating in Romania must register with the National Invoice Registry (NIR) before sending electronic invoices. The NIR acts as a central repository for all electronic invoices issued in the country.

Tip 3: Use Approved Invoice Operators

Businesses can opt to use approved invoice operators to facilitate the sending and receiving of electronic invoices. These operators handle the technical aspects of electronic invoicing, including data encryption and secure transmission.

Tip 4: Adhere to Invoice Format Requirements

Electronic invoices in Romania must adhere to specific format requirements as defined by law. Ensure that invoices include all mandatory fields, such as invoice number, date, and recipient information.

Tip 5: Integrate with Accounting Systems

Integrating electronic invoicing functionalities into accounting systems can streamline invoice processing and reduce manual errors. Consider automating invoice generation, sending, and archiving to enhance efficiency.

By leveraging these tips, businesses can effectively implement electronic invoicing in Romania, paving the way for improved efficiency, reduced costs, and enhanced compliance. For more in-depth insights into Romania's electronic invoicing system, refer to Facturi Ciolacu: Decoding The Electronic Invoicing System In Romania.

Facturi Ciolacu: Decoding The Electronic Invoicing System In Romania

Facturi Ciolacu, the e-invoicing system in Romania, plays a crucial role in modernizing and streamlining business operations. To fully understand its significance, it is essential to decode its key aspects, which are meticulously examined below.

- Legal Obligation: Romanian businesses are legally bound to use Facturi Ciolacu.

- Electronic Format: Invoices are issued and received solely in electronic format.

- Automated Validation:Invoices are automatically validated by the system, ensuring their authenticity and integrity.

- Digital Signature: Invoices are digitally signed, providing non-repudiation and security.

- Centralized Platform: The system operates on a centralized platform, facilitating easy access and management.

- Interoperability: Facturi Ciolacu seamlessly integrates with other business systems, enhancing efficiency.

These key aspects work in concert to create a robust and efficient e-invoicing system. By automating invoice processing, Facturi Ciolacu reduces errors, streamlines operations, and enables businesses to focus on value-adding activities. Furthermore, its centralized platform fosters collaboration and transparency, while the legal obligation ensures compliance and accountability. Ultimately, Facturi Ciolacu is a cornerstone of Romania's digital transformation journey, driving economic growth and competitiveness.

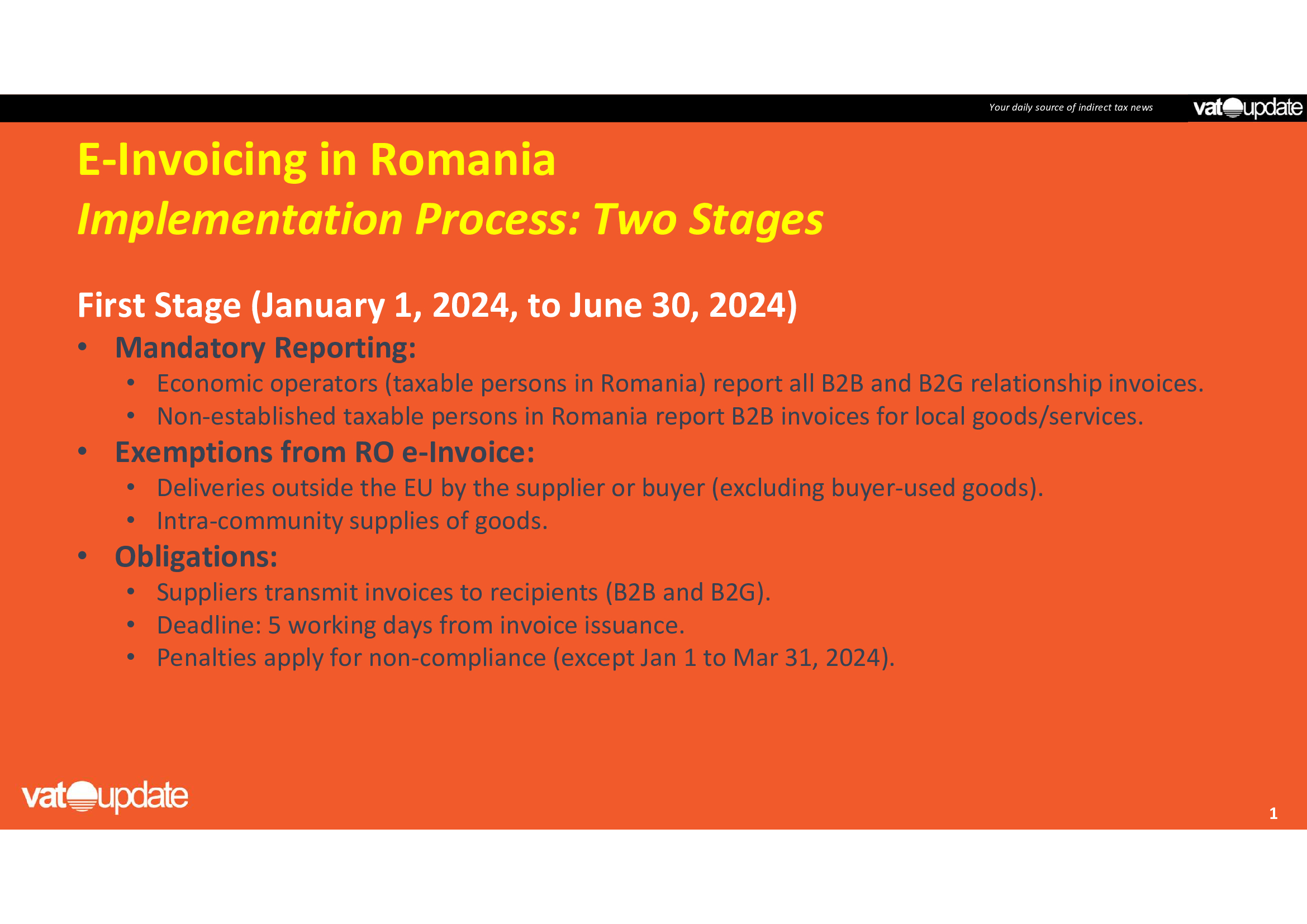

Summary of the E-Invoicing/Real Time Reporting Mandate in Romania as of - Source www.vatupdate.com

Facturi Ciolacu: Decoding The Electronic Invoicing System In Romania

Electronic invoicing, also known as e-invoicing, is the exchange of invoices in a structured electronic format. It is a key component of the Romanian government's efforts to modernize the country's tax system and reduce the administrative burden on businesses.

WP Invoices – PDF Electronic Invoicing System – Promex® - Source promex.me

Facturi Ciolacu is a Romanian company that provides electronic invoicing services. The company's platform allows businesses to create, send, and receive invoices electronically. Facturi Ciolacu also offers a range of other services, such as electronic signature and archiving.

The benefits of electronic invoicing are numerous. For businesses, electronic invoicing can save time and money. It can also help to improve accuracy and reduce errors. For governments, electronic invoicing can help to increase tax revenues and reduce the cost of tax administration.

Facturi Ciolacu is playing a key role in the adoption of electronic invoicing in Romania. The company's platform is easy to use and affordable, making it a viable option for businesses of all sizes. Facturi Ciolacu is also working with the Romanian government to develop and implement the country's electronic invoicing system.

The adoption of electronic invoicing in Romania is a positive development. It will help to modernize the country's tax system and reduce the administrative burden on businesses. Facturi Ciolacu is a key player in this process, and the company's services are helping to make electronic invoicing accessible to businesses of all sizes.

Key insights:

| Benefit | Effect |

|---|---|

| Time savings | Businesses can save time by automating the invoicing process. |

| Cost savings | Businesses can save money on postage and other costs associated with paper invoices. |

| Improved accuracy | Electronic invoices are less likely to contain errors than paper invoices. |

| Increased tax revenues | Electronic invoicing can help governments to increase tax revenues by making it more difficult for businesses to evade taxes. |

| Reduced cost of tax administration | Electronic invoicing can help governments to reduce the cost of tax administration by making it easier to process tax returns. |

Conclusion

The adoption of electronic invoicing in Romania is a positive development. It will help to modernize the country's tax system and reduce the administrative burden on businesses. Facturi Ciolacu is a key player in this process, and the company's services are helping to make electronic invoicing accessible to businesses of all sizes.

The Romanian government should continue to support the adoption of electronic invoicing. The government can do this by providing incentives to businesses that adopt electronic invoicing and by working with companies like Facturi Ciolacu to develop and implement the country's electronic invoicing system.