This article is especially relevant today, as people are living longer and facing rising healthcare costs in retirement. Planning ahead and making informed decisions about saving and pension options can significantly increase financial security during retirement.

Through extensive analysis and research, we have put together this comprehensive Pension Planning For 2025: Early Retirement Strategies And Savings Tips guide to help individuals make the right decisions for their financial future.

| Traditional Pension Plan | Defined Contribution Plan |

|---|---|

| Guaranteed monthly payments in retirement | Individual investment decisions and variable returns |

| Set contribution rates | Flexible contributions |

| Limited investment options | Wide range of investment choices |

Main Article Topics:

FAQ

This comprehensive guide tackles the complexities of pension planning, empowering individuals to navigate the path towards a financially secure retirement in 2025. Our experts provide invaluable insights, addressing common queries and misconceptions to arm readers with the knowledge necessary to make informed decisions about their financial future.

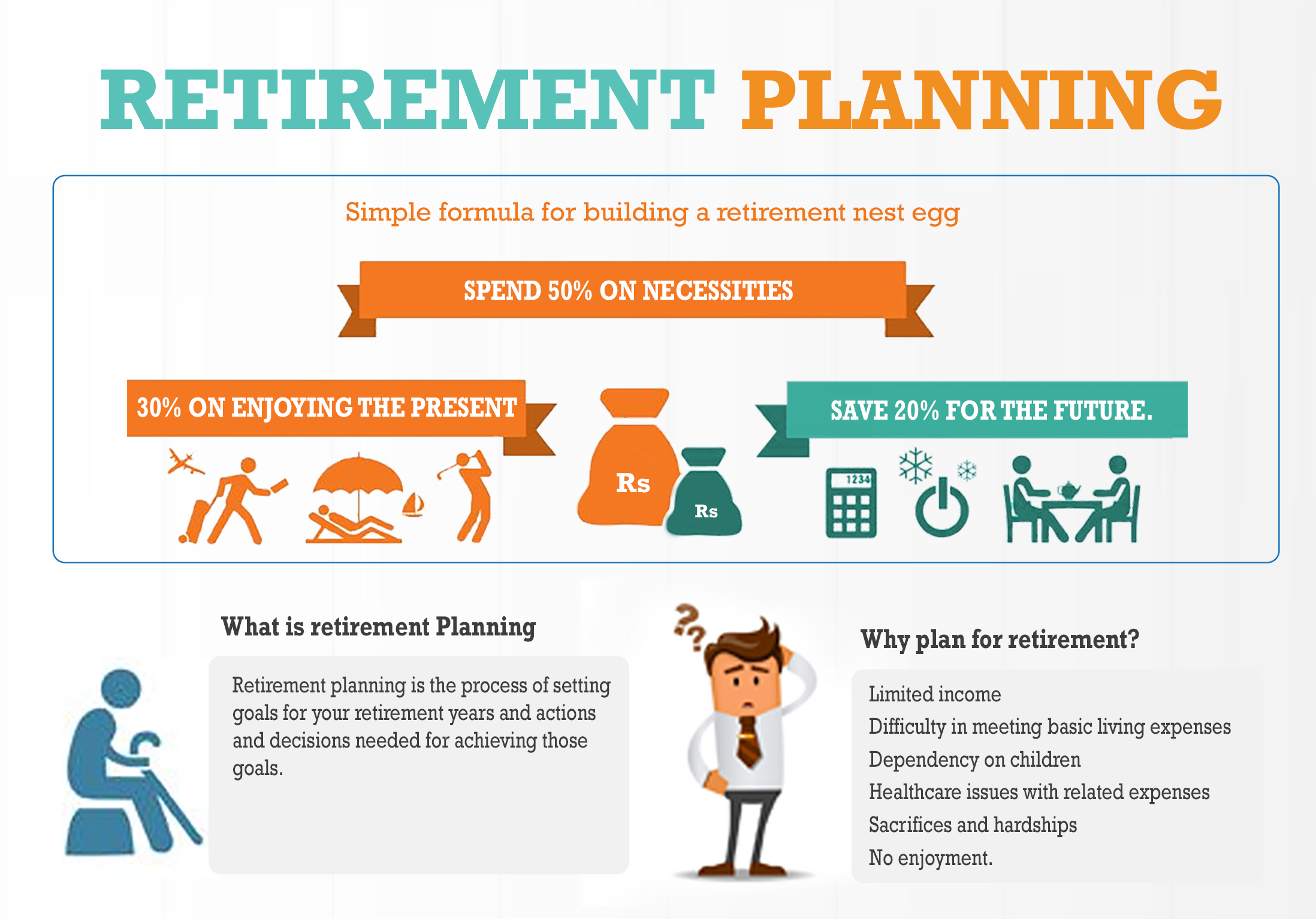

Retirement Planning | JamaPunji - Source jamapunji.pk

Question 1: What is the best age to start planning for retirement?

The sooner you begin planning for retirement, the more time you have for your investments to grow. It is never too early to start putting away money for your future, even if it is just a small amount each month. Make contributions to your retirement accounts, such as a 401(k) or IRA, as early as possible and consider increasing your contributions as your income grows.

Question 2: How much should I save for retirement?

The amount you need to save for retirement will vary depending on your individual circumstances, such as your income, expenses, and desired retirement lifestyle. A general rule of thumb is to aim for saving around 10-15% of your pre-tax income each year. Consider consulting with a financial advisor who can help you develop a personalized retirement savings plan.

Question 3: What are the different types of retirement accounts?

There are several types of retirement accounts available, each with its own unique advantages and disadvantages. Some common types include 401(k) plans, IRAs, and annuities. Research the different types of accounts and their features to determine which ones are right for your specific needs and financial goals.

Question 4: How can I maximize my retirement savings?

There are many strategies you can employ to maximize your retirement savings. Some effective methods include contributing to your retirement accounts on a regular basis, taking advantage of employer matching contributions, investing in a diversified portfolio, and minimizing unnecessary expenses. Seek professional guidance from a financial advisor to explore additional strategies that can help you reach your retirement savings goals.

Question 5: What are the tax implications of retirement savings?

The tax implications of retirement savings vary depending on the type of account you choose. Some accounts offer tax-deferred growth, while others provide tax-free withdrawals in retirement. It is essential to understand the tax implications of each type of account before making any decisions about where to invest your retirement savings.

Question 6: What should I do if I am behind on my retirement savings?

If you are behind on your retirement savings, it is important to take action as soon as possible. Consider increasing your retirement contributions, exploring catch-up contributions, and reevaluating your spending habits. Seeking guidance from a financial advisor can help you develop a plan to get back on track and achieve your retirement savings goals.

By addressing these common questions and concerns, this FAQ section provides a solid foundation for informed decision-making. Remember, planning for retirement is a marathon, not a sprint. Start early, save consistently, and seek professional advice when needed to ensure a financially secure and fulfilling retirement.

This FAQ section serves as a valuable resource, but it is essential to seek personalized advice from qualified professionals to address your specific financial needs and circumstances. With careful planning and prudent execution, you can build a secure financial future for yourself and your loved ones.

Tips

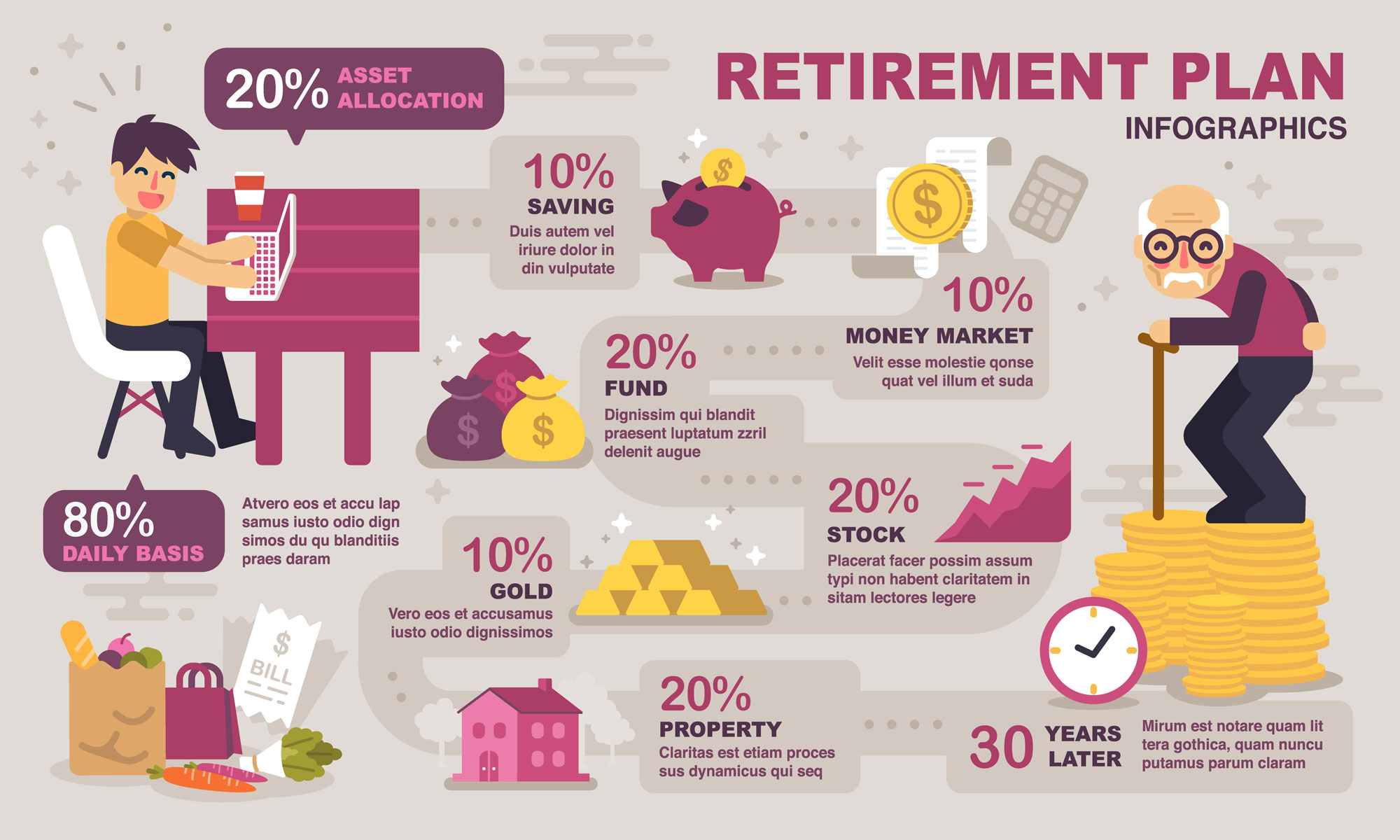

Infographics: 7 Retirement Savings Goals for 2017 - Source www.sensefinancial.com

Take control of your retirement planning early on. With strategic planning and savvy savings, early retirement can become a reality. Here are some valuable tips to guide your path:

Tip 1: Start Saving Early

Time and compounding can work wonders for your retirement savings. Begin contributing to your pension or other retirement plans as soon as possible. Every dollar you save today will grow exponentially over time.

Tip 2: Maximize Retirement Contributions

Take advantage of any employer-sponsored retirement plans, such as 401(k)s. Many employers offer matching contributions, essentially doubling your savings. Contribute as much as you can afford to these plans.

Tip 3: Consider a Roth IRA or Backdoor Roth IRA

A Roth IRA allows you to contribute after-tax dollars, but your earnings grow tax-free and are withdrawn tax-free in retirement. A Backdoor Roth IRA is a strategy available to higher earners who may not qualify for a traditional Roth IRA. Consult a financial advisor to explore these options.

Tip 4: Increase Your Earning Potential

Investing in yourself through education, certifications, and skills development can increase your earning potential. A higher income means more money to save for retirement and achieve your financial goals.

Tip 5: Seek Professional Advice

Navigating retirement planning can be complex. Consult with a qualified financial advisor who can guide you based on your specific circumstances. They can help you create a customized retirement strategy and recommend suitable investments.

By following these tips, you can position yourself for a secure and comfortable early retirement. Remember that planning and discipline are key. The sooner you take action, the closer you'll get to your retirement dreams.

Pension Planning For 2025: Early Retirement Strategies And Savings Tips provides more in-depth insights into retirement planning. Stay informed and empowered to make sound financial decisions for your future.

Pension Planning For 2025: Early Retirement Strategies And Savings Tips

As we approach 2025, comprehensive pension planning becomes paramount to secure a comfortable retirement. Early planning and strategic savings are key aspects that will shape the financial landscape for retirees.

- Maximize Contributions: Take advantage of tax-advantaged retirement accounts and ensure regular contributions to grow investments over time.

- Diversify Portfolio: Spread investments across diverse asset classes to manage risk and enhance returns, aiming for a balance that aligns with risk tolerance.

- Consider Annuities: Explore fixed annuities to provide a guaranteed stream of income in retirement, ensuring financial stability.

- Delay Retirement Age: If feasible, consider working beyond the traditional retirement age to increase savings and reduce the time spent drawing down retirement funds.

- Seek Professional Advice: Consult with a financial planner to tailor a comprehensive retirement plan that considers individual circumstances and goals.

- Start Saving Early: The power of compounding over time makes early saving essential for building a substantial retirement nest egg.

By implementing these key aspects and taking proactive steps towards pension planning, individuals can prepare for a secure and fulfilling retirement in 2025 and beyond. It is crucial to assess individual circumstances, conduct thorough research, and consult with financial professionals to navigate the complexities of pension planning successfully.

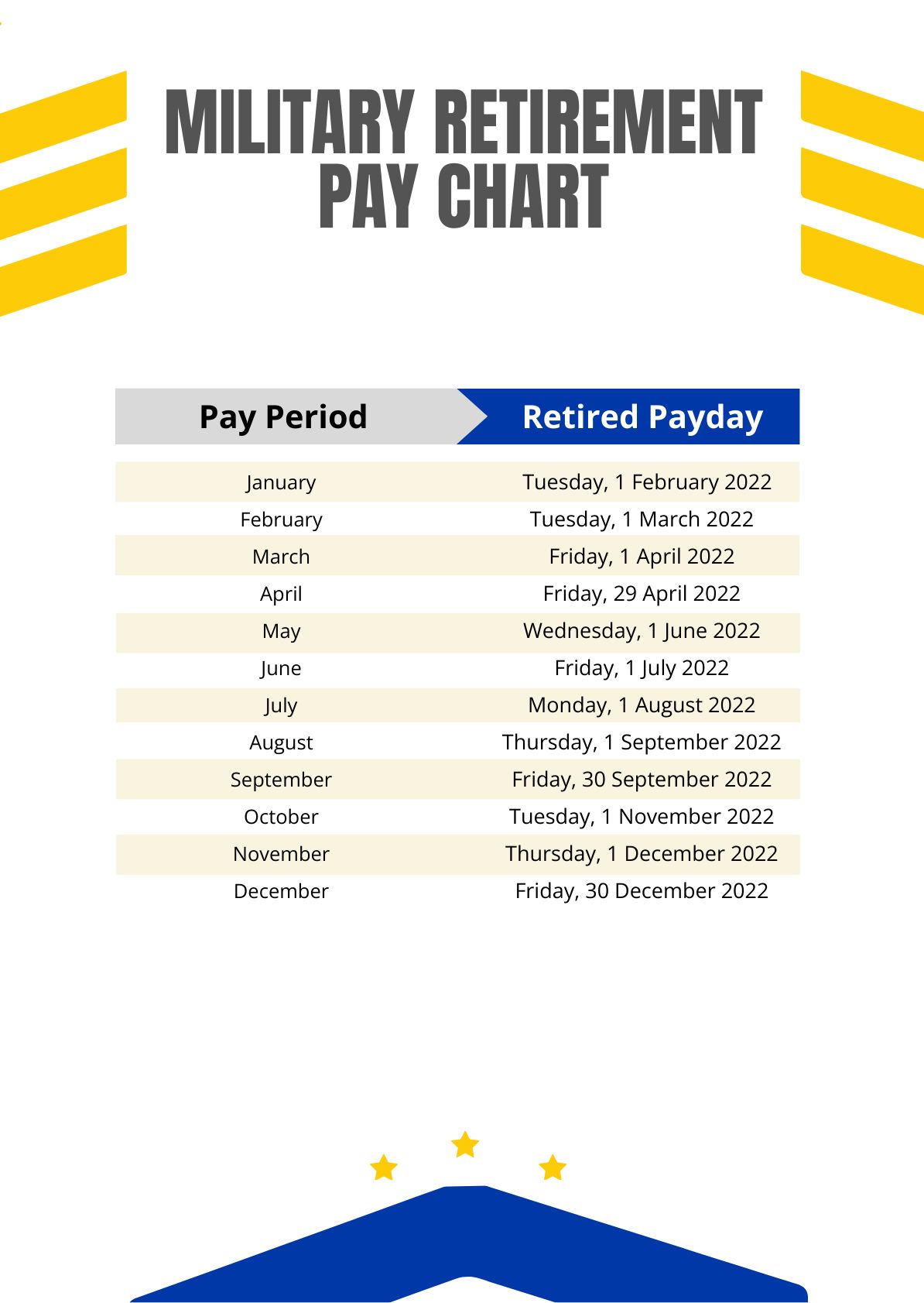

Usps Retirement Pay Chart 2025 - Cicily Estelle - Source evaniayveronika.pages.dev

Pension Planning For 2025: Early Retirement Strategies And Savings Tips

Planning for retirement is essential, and with the right strategies and savings tips, you can retire early and live comfortably. This article will explore the connection between pension planning for 2025 and early retirement strategies and savings tips, providing valuable insights and practical advice to help you achieve your retirement goals.

Retirement Planning | Financial Planning Concepts - Source www.fpcamerica.com

Early retirement is becoming increasingly popular, as people seek to enjoy their golden years while they are still healthy and active. However, retiring early requires careful planning and preparation, as you will need to ensure that you have sufficient financial resources to support yourself throughout your retirement. Pension planning plays a crucial role in this process, as it provides a regular income stream that can help you cover your living expenses.

There are a number of different pension plans available, each with its own advantages and disadvantages. It is important to compare the different options and choose the plan that best meets your needs. You should also consider your investment strategy, as the returns you earn on your investments will have a significant impact on your retirement income.

In addition to pension planning, there are a number of other savings tips that can help you retire early. These include:

- Saving early and often

- Investing wisely

- Reducing your expenses

- Increasing your income

By following these tips, you can increase your chances of retiring early and living the life you want.

Conclusion

Pension planning for 2025 is essential for anyone who wants to retire early and live comfortably. By following the strategies and savings tips outlined in this article, you can increase your chances of achieving your retirement goals.

The key to successful pension planning is to start early and save consistently. The sooner you start saving, the more time your money has to grow. And the more money you save, the more secure your retirement will be.