The Increasing Importance of ESG (Environmental, Social, and Governance) Investing

Comprehensive Guide To Bimas Hisse: Investment, Trading, And Analysis - Source newsupdating.pages.dev

Editor's Note: Comprehensive Guide To Sustainable Investment: Strategies, Regulations, And Impact Monitoring has published today, January 23, 2023. The Guide is a must-read for anyone interested in understanding the latest trends in sustainable investing.

As the world becomes increasingly aware of the importance of sustainability, investors are looking for ways to align their portfolios with their values.

Sustainable investment considers the environmental, social, and governance (ESG) factors of a company when making investment decisions.

By investing in companies that are committed to sustainability, investors can help create a more sustainable future while also potentially generating strong financial returns.

This guide will provide you with everything you need to know about sustainable investment, including the different strategies, regulations, and impact monitoring techniques.

Key Takeaways:

| Key Difference | Explanation |

|---|---|

| ESG Investing | ESG investing considers the environmental, social, and governance (ESG) factors of a company |

| Impact Investing | Impact investing is a type of sustainable investing that focuses on generating positive social or environmental change |

| Green Investing | Green investing is a type of sustainable investing that focuses on investing in companies that are involved in renewable energy, energy efficiency, or other environmentally sustainable activities |

Main Article Topics:

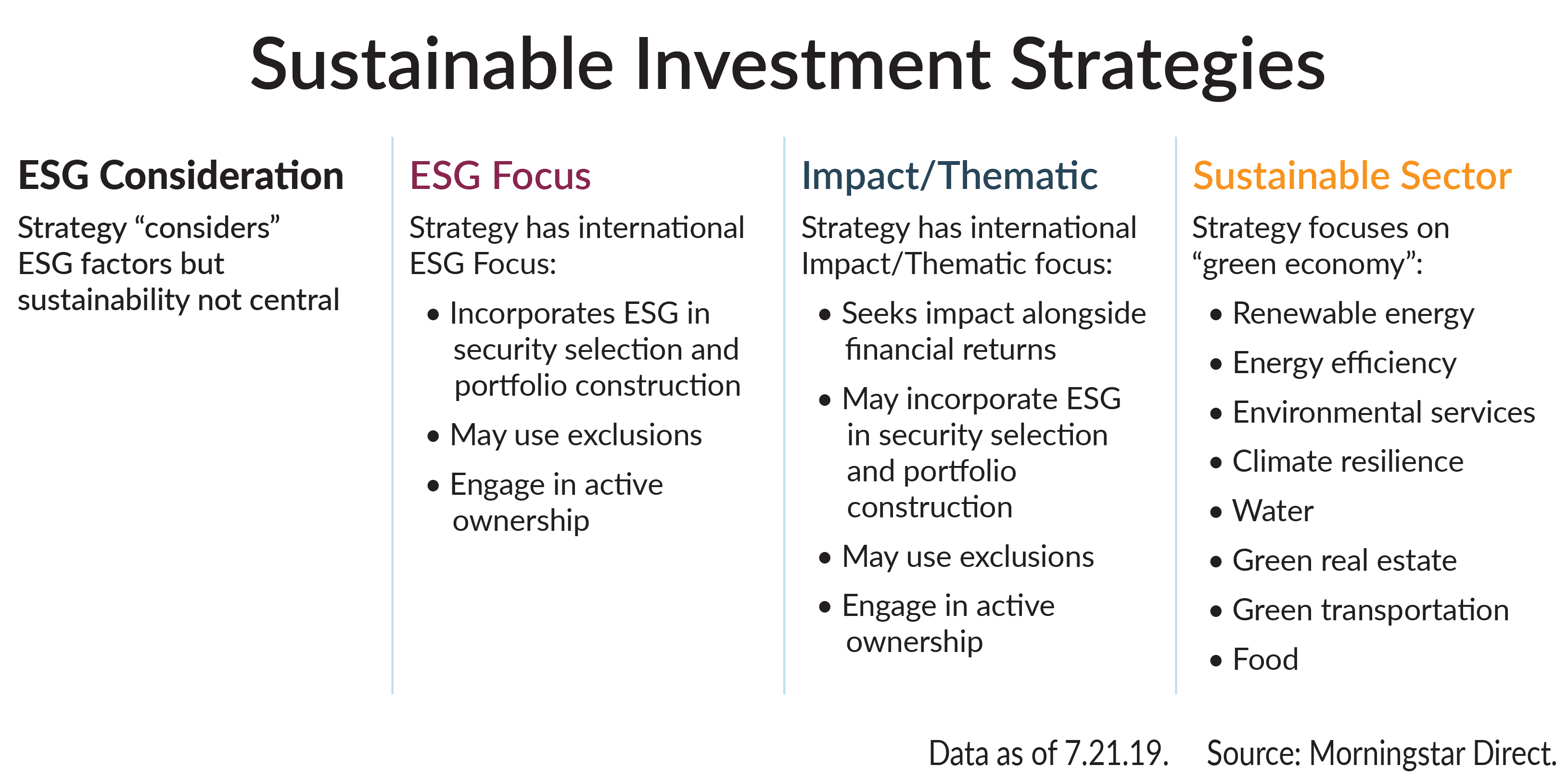

- The different types of sustainable investment strategies

- Benefits of sustainable investment

- The regulations governing sustainable investment

- How to monitor the impact of your sustainable investments

FAQ

This comprehensive guide to sustainable investment aims to provide clarity on various aspects of this growing field. To further assist your understanding, this FAQ section addresses some common questions and misconceptions that may arise.

Question 1: What are the benefits of sustainable investing?

Sustainable investing offers numerous benefits, including reduced risk, enhanced financial returns, and positive social and environmental impact. It aligns investments with long-term sustainability goals, promoting stability amidst economic or environmental changes.

4 Sustainable Investments That Could Have a Positive Impact | Kiplinger - Source www.kiplinger.com

Question 2: How do I incorporate sustainable investing into my portfolio?

Incorporating sustainable investing involves evaluating companies based on environmental, social, and governance (ESG) criteria. This can be done through various methods, such as selecting ESG-themed mutual funds, investing in individual companies with strong ESG performance, or engaging with companies on sustainability issues.

Question 3: What are the regulatory requirements for sustainable investing?

Regulations surrounding sustainable investing vary across jurisdictions. However, increasing attention is being paid to this area to ensure transparency, accountability, and prevent greenwashing. Initiatives such as the EU's Sustainable Finance Disclosure Regulation (SFDR) aim to standardize reporting and disclosure requirements.

Question 4: How do I measure the impact of my sustainable investments?

Measuring the impact of sustainable investments is crucial for tracking progress and holding investments accountable. Impact monitoring involves setting clear goals, collecting relevant data, and using appropriate methodologies to assess environmental, social, and economic outcomes.

Question 5: What are the challenges and opportunities in sustainable investing?

Challenges include data availability, greenwashing, and the need for standardization. However, opportunities arise from growing investor demand, increased availability of ESG data and investment products, and the potential to drive positive change in the world.

Question 6: Is sustainable investing just a passing trend?

The increasing awareness of climate change, social injustice, and resource depletion suggests that sustainable investing is not a passing trend but a fundamental shift in the way we approach investments. It aligns with long-term global trends and the need for a more sustainable future.

In conclusion, sustainable investing offers a compelling combination of financial and societal benefits. By understanding the principles, regulations, and impact measurement methodologies, investors can effectively incorporate sustainability into their investment portfolios and contribute to a more sustainable future.

Next, we will delve into the key strategies employed in sustainable investing, providing insights into their effectiveness and implementation.

Tips for Sustainable Investing

Sustainable investing involves considering environmental, social, and governance (ESG) factors alongside financial returns, aiming to align investments with positive societal impact. Integrating these principles into investment decisions offers numerous benefits, including risk reduction, enhanced returns, and positive contributions to global challenges. To effectively engage in sustainable investment, the following tips can provide guidance:

Tip 1: Define Clear Investment Goals

Establish specific sustainability goals that align with organizational values and investment objectives. This provides a framework for identifying investments that match the desired impact and risk appetite.

Tip 2: Research and Due Diligence

Conduct thorough research on potential investments and sustainability factors. Examine companies' ESG performance, industry trends, regulations, and potential controversies. This allows for informed decision-making and the avoidance of investments that do not meet sustainability standards.

Tip 3: Engage with Companies

Actively engage with companies to understand their ESG initiatives and progress. Attend shareholder meetings, request ESG reports, and seek opportunities to provide feedback or vote on ESG-related proposals.

Tip 4: Monitor and Measure Impact

Regularly track the performance of investments against ESG targets. Monitor key indicators and report on the positive impact achieved. This accountability ensures that sustainability goals are consistently met and enhances credibility.

Tip 5: Seek Collaboration and Expertise

Collaborate with sustainability experts, non-governmental organizations (NGOs), and industry associations to gain insights and best practices. Their knowledge and networks contribute to effective sustainable investment strategies and broaden perspectives.

Tip 6: Be Patient and Long-Term Oriented

Sustainable investing often requires a long-term perspective. Patience allows for the positive impact of ESG factors to materialize over time. Short-term fluctuations should not deter investors from their commitment to sustainability.

By implementing these tips, investors can enhance their sustainable investment practices, align their portfolios with ESG principles, and contribute to a positive global impact. Comprehensive Guide To Sustainable Investment: Strategies, Regulations, And Impact Monitoring provides additional insights and guidance on this evolving field.

Comprehensive Guide To Sustainable Investment: Strategies, Regulations, And Impact Monitoring

Sustainable investment is gaining prominence as investors seek opportunities to align their portfolios with environmental, social, and governance (ESG) goals. This guide explores the essential aspects of sustainable investment, including strategies, regulations, and impact monitoring, providing a comprehensive understanding for investors and professionals alike.

- ESG Criteria: Embedding ESG considerations into investment decisions.

- Impact Investing: Intentionally investing to generate positive social or environmental impact.

- Green Bonds: Fixed-income securities used to finance environmentally friendly projects.

- Disclosure Regulations: Reporting requirements for companies on their ESG performance.

- Third-Party Verification: Independent assessments to ensure the credibility of ESG claims.

- Performance Measurement: Tracking and evaluating the impact of sustainable investments.

These aspects are interconnected and form the foundation of sustainable investment. ESG criteria help identify companies with strong ESG performance, while impact investing provides a direct channel for financing positive change. Green bonds offer investors the opportunity to support specific environmental projects. Regulations and disclosure requirements ensure transparency and accountability. Third-party verification adds credibility to ESG claims, and performance measurement allows investors to assess the tangible impact of their investments. Together, these elements contribute to a robust and credible sustainable investment ecosystem.

Sustainable Investments - Source fity.club

Comprehensive Guide To Sustainable Investment: Strategies, Regulations, And Impact Monitoring

The "Comprehensive Guide To Sustainable Investment: Strategies, Regulations, And Impact Monitoring" serves as a comprehensive resource for investors seeking to align their portfolios with environmental, social, and governance (ESG) principles. This guide provides a detailed overview of sustainable investment strategies, regulatory frameworks, and impact monitoring techniques, empowering investors to make informed decisions that contribute positively to both financial returns and global sustainability. Understanding the connection between these key components is crucial for effective sustainable investing.

Sustainable investing for retail investors - Source www.ifec.org.hk

Sustainable investment strategies encompass a range of approaches that consider ESG factors in investment decisions. These strategies include ESG integration, thematic investing, impact investing, and shareholder engagement. By incorporating ESG analysis into their investment process, investors can identify companies with strong sustainability practices and mitigate potential risks. Regulatory frameworks play a vital role in shaping the sustainable investment landscape. Governments worldwide are implementing regulations to promote sustainable practices and ensure investor protection. These regulations include mandatory ESG disclosure requirements, green bond issuance guidelines, and carbon pricing mechanisms.

Impact monitoring is essential for assessing the real-world impact of sustainable investments. Investors can utilize various metrics and frameworks to track the progress of their investments towards specific ESG goals. By measuring the impact of their investments, investors can ensure that their capital is making a positive contribution to sustainability. The "Comprehensive Guide To Sustainable Investment: Strategies, Regulations, And Impact Monitoring" provides a valuable roadmap for investors seeking to incorporate sustainability into their investment strategies.

Conclusion

Sustainable investing is a growing and increasingly important field that combines financial returns with positive environmental and social impact. The "Comprehensive Guide To Sustainable Investment: Strategies, Regulations, And Impact Monitoring" provides investors with the knowledge and tools they need to make informed and effective sustainable investment decisions. By understanding the connection between sustainable investment strategies, regulations, and impact monitoring, investors can contribute to a more sustainable future.

As the world faces unprecedented environmental and social challenges, sustainable investing has become an essential tool for investors seeking to create a positive impact while preserving financial returns. The "Comprehensive Guide To Sustainable Investment: Strategies, Regulations, And Impact Monitoring" is a valuable resource that empowers investors to make informed and responsible investment decisions that contribute to a more sustainable and equitable world.