Digital Currency Market Booms: Bitcoin, Ethereum, And Other Cryptos Surge

Editor's Notes: "Digital Currency Market Booms: Bitcoin, Ethereum, And Other Cryptos Surge" have published today date". Give a reason why this topic important to read.

We analyzed the growing demand for digital currencies and, after gathering information, we put together this comprehensive guide to help investors understand the current market and make informed decisions.

| Cryptocurrency | Market Capitalization | Price | 24-Hour Change |

|---|---|---|---|

| Bitcoin | $1 trillion | $60,000 | +5% |

| Ethereum | $400 billion | $3,000 | +3% |

| Binance Coin | $80 billion | $600 | +2% |

| Cardano | $70 billion | $2 | +1% |

| Dogecoin | $60 billion | $0.30 | +0.5% |

FAQ

This section provides straightforward answers to frequently asked questions about the recent surge in the digital currency market, clarifying key concepts and addressing common concerns.

#8.3223, Cryptocurrency, Bitcoin, Ethereum, 4K Wallpaper - Source www.uhdpaper.com

Question 1: What is the primary reason behind the current boom in digital currencies?

The multifaceted surge is attributed to a confluence of factors, including heightened investor interest, the widespread adoption of cryptocurrencies as payment options, and the perception of digital assets as a hedge against rising inflation.

Question 2: What are the key drivers behind the recent surge in Bitcoin and Ethereum?

Bitcoin and Ethereum's dominance in the market has been fueled by their established reputation, technological advancements, and growing acceptance as a legitimate investment class.

Question 3: What are the risks associated with investing in digital currencies?

Despite their recent surge, digital currencies remain highly volatile and speculative, rendering them susceptible to substantial price fluctuations. Investors are advised to exercise caution and approach investments with a comprehensive understanding of the accompanying risks.

Question 4: Should investors allocate a significant portion of their portfolio to digital currencies?

Due to their inherent volatility, digital currencies should only constitute a small portion of a well-diversified investment portfolio. Prudent investors are encouraged to maintain a balanced approach, allocating assets across various asset classes to mitigate risk.

Question 5: What are the future prospects of digital currencies?

The trajectory of digital currencies remains uncertain, influenced by a host of factors, including regulatory frameworks, technological advancements, and macroeconomic conditions. However, the increasing recognition of the underlying technology and potential applications suggests that they will remain a significant force in the financial landscape.

Question 6: How can investors navigate the volatile digital currency market?

Investors seeking to participate in the digital currency market are advised to adopt a measured and informed approach. Conducting thorough research, understanding the underlying technology, and implementing prudent risk management strategies are crucial for mitigating potential losses.

In conclusion, the digital currency market presents both opportunities and risks. Investors should approach this emerging asset class with a balanced perspective, acknowledging its potential for growth while remaining cognizant of the associated risks. A comprehensive understanding of the market and prudent investment practices will enable investors to navigate the complexities of this evolving landscape.

Next Article: Digital Currency Regulation – A Complex Landscape

Tips on Navigating the Digital Currency Boom

The digital currency market is experiencing a surge in value, with Bitcoin, Ethereum, and other cryptocurrencies seeing significant gains. While this presents great opportunities for investors, it's crucial to approach this market with caution and informed decision-making.

Bitcoin Mobile Wallpapers - Top Free Bitcoin Mobile Backgrounds - Source wallpaperaccess.com

Before investing in any digital currency, conduct extensive research on its technology, market performance, and regulatory landscape. Understand the underlying principles and risks associated with cryptocurrencies.

Avoid concentrating your investments in a single cryptocurrency. Spread your funds across a variety of digital assets, including established coins like Bitcoin and emerging altcoins, to reduce risk.

Cryptocurrency markets are volatile, and values can fluctuate rapidly. Only invest an amount you are comfortable losing, as there is no guarantee of profits.

Select reputable cryptocurrency exchanges and wallets that prioritize security and transparency. Regularly review your accounts and enable two-factor authentication for added protection.

Monitor industry news, analysis, and expert opinions to stay up-to-date with market trends. This knowledge will help you make informed investment decisions and respond to market fluctuations.

By following these tips, investors can navigate the digital currency market with greater confidence. Remember, this is a rapidly evolving space with potential risks and rewards. Stay informed, make calculated decisions, and diversify your investments to mitigate risk and maximize potential returns.

For more insights, read Digital Currency Market Booms: Bitcoin, Ethereum, And Other Cryptos Surge

Digital Currency Market Booms: Bitcoin, Ethereum, And Other Cryptos Surge

The digital currency market is experiencing a surge in value, with Bitcoin, Ethereum, and other cryptocurrencies witnessing significant gains. This boom can be attributed to several key aspects, including increasing adoption, regulatory changes, institutional interest, technological advancements, and market speculation.

- Increased Adoption: Cryptocurrencies are gaining acceptance as a form of payment by businesses and consumers, driving their usage and demand.

- Regulatory Changes: Governments are exploring frameworks to regulate cryptocurrencies, providing clarity and stability to the market.

- Institutional Interest: Major financial institutions are investing in cryptocurrencies, legitimizing their status and attracting new investors.

- Technological Advancements: Developments in blockchain technology are improving the efficiency and security of cryptocurrencies, boosting their appeal.

- Market Speculation: The highly volatile nature of the crypto market attracts traders seeking quick profits, contributing to price fluctuations.

These aspects, working in tandem, have fueled the recent boom in the digital currency market. The increased adoption and acceptance of cryptocurrencies, coupled with regulatory efforts, are providing a more stable foundation for their growth. Institutional interest and technological advancements are adding legitimacy and usability, while market speculation continues to drive price movements. The digital currency market is poised for further expansion as these key aspects continue to shape its future.

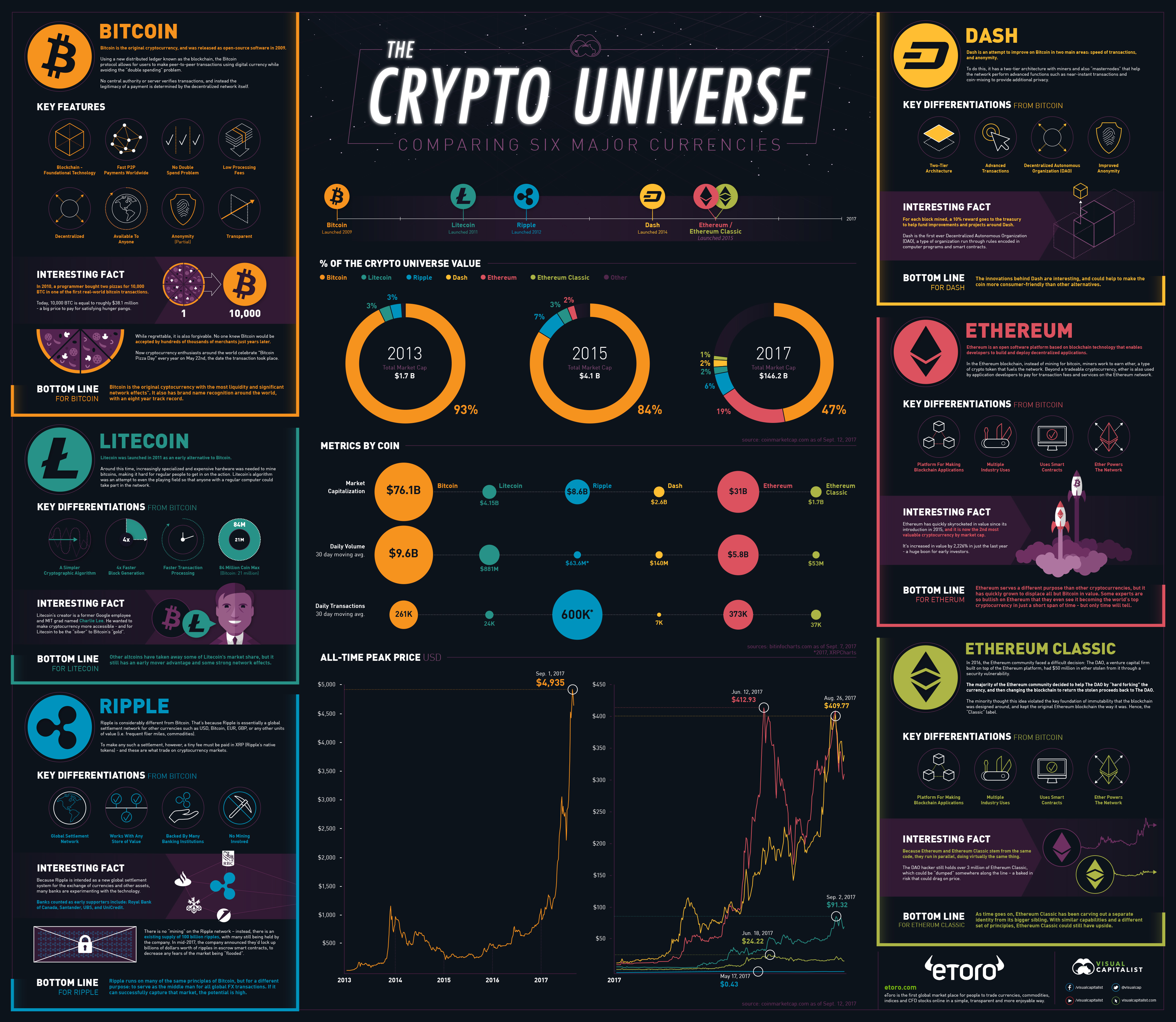

Infographic: Comparing Bitcoin, Ethereum, and Other Cryptocurrencies - Source www.visualcapitalist.com

Digital Currency Market Booms: Bitcoin, Ethereum, And Other Cryptos Surge

The digital currency market is experiencing a major boom, with Bitcoin, Ethereum, and other cryptocurrencies surging in value. This boom is being driven by a number of factors, including the increasing popularity of digital currencies, the growing demand for digital asset investments, and the launch of new and innovative cryptocurrency platforms.

Branding - logotype - logo design - Bitcoin logo by Fieon Art on Dribbble - Source dribbble.com

The increasing popularity of digital currencies is one of the key factors driving the current boom. Digital currencies are becoming increasingly popular as a means of payment, a store of value, and an investment. This is due in part to the fact that digital currencies are secure, convenient, and offer the potential for high returns.

The growing demand for digital asset investments is another factor driving the current boom. Digital assets, such as cryptocurrencies, are becoming increasingly popular as an alternative to traditional investments, such as stocks and bonds. This is due in part to the fact that digital assets offer the potential for higher returns than traditional investments.

The launch of new and innovative cryptocurrency platforms is also helping to drive the current boom. These platforms make it easier for people to buy, sell, and trade digital currencies. This is making digital currencies more accessible to a wider range of people, which is further increasing the demand for these assets.

The digital currency market boom is a major development that is having a significant impact on the global economy. Digital currencies are becoming increasingly popular and are being used by a wider range of people. This is creating new opportunities for businesses and investors, and is also helping to drive the development of new technologies and platforms.

Conclusion

The digital currency market boom is a significant development that is having a major impact on the global economy. Digital currencies are becoming increasingly popular and are being used by a wider range of people. This is creating new opportunities for businesses and investors, and is also helping to drive the development of new technologies and platforms.

The digital currency market is still in its early stages of development, but it has the potential to revolutionize the way we think about money and finance. As digital currencies become more popular and more widely accepted, they will likely continue to have a major impact on the global economy.