Concerned about the upcoming tax changes in 2025? Look no further than "IRS 2025: A Comprehensive Guide To Tax Changes And Implications", the most up-to-date and comprehensive guide available.

Editor's Note: " IRS 2025: A Comprehensive Guide To Tax Changes And Implications" was published on [date] to provide the latest information on the tax law changes that will impact individuals and businesses in 2025 and beyond.

Through extensive analysis and research, our team of experts has compiled this essential resource to help you navigate the complexities of the new tax landscape.

| Tax Changes | Implications |

|---|---|

| Increased Standard Deduction | Reduced taxable income for many taxpayers |

| Lower Tax Rates | Potential tax savings for both individuals and businesses |

| Expanded Child Tax Credit | Increased financial support for families with children |

Whether you're an individual taxpayer, a business owner, or a tax professional, "IRS 2025: A Comprehensive Guide To Tax Changes And Implications" is an indispensable tool to help you understand the changes, plan your finances, and make informed decisions come tax time.

FAQ

This comprehensive guide addresses the most commonly asked questions and concerns regarding the significant tax changes and implications under IRS 2025. Our team of tax experts has carefully curated this FAQ section to provide readers with clear and concise answers, dispelling any misconceptions and equipping them with the necessary knowledge to navigate the complexities of the new tax landscape.

Irs 2025 401k Contribution Limits - Pammy Batsheva - Source alinevkimberlyn.pages.dev

Question 1: What are the most significant changes to the tax code under IRS 2025?

The IRS 2025 tax code introduces several notable changes, including the elimination of certain deductions and credits, the implementation of a new simplified standard deduction option, and adjustments to tax rates for various income brackets.

Question 2: How will these changes affect my tax liability?

The impact of the tax changes will vary depending on individual circumstances. Some taxpayers may experience a decrease in their tax liability due to the increased standard deduction, while others may face higher taxes due to the elimination of certain deductions. It is recommended to consult with a tax professional or utilize tax preparation software to accurately determine your tax liability.

Question 3: Are there any exemptions or deductions that I can still claim under IRS 2025?

While certain deductions have been eliminated, several notable exemptions and deductions remain available. These include the mortgage interest deduction, charitable contributions deduction, and state and local taxes deduction up to a certain limit.

Question 4: How can I prepare for the upcoming tax changes?

To prepare for the IRS 2025 tax changes, it's crucial to review your financial situation and consult with a tax professional or tax advisor. This will help you optimize your tax savings and minimize any potential tax liability.

Question 5: What resources are available to help me understand the IRS 2025 tax changes?

The IRS website provides a wealth of information and resources to assist taxpayers in understanding the IRS 2025 tax changes. Additionally, tax professionals, financial advisors, and numerous online sources can provide valuable guidance and support.

Question 6: Are there any additional changes or implications that I need to be aware of?

The IRS 2025 tax code is complex and far-reaching, with potential implications for various aspects of financial planning and tax liability. It's essential to stay informed about any updates or additional changes that may arise in the future.

By carefully considering the information provided in this FAQ section, you can gain a deeper understanding of the IRS 2025 tax changes and their potential implications. Remember, it's always advisable to consult with a qualified tax professional for personalized guidance and assistance in navigating the complexities of the new tax landscape.

Transitioning to the next article section: Explore other crucial aspects of IRS 2025 and its impact on various financial and tax-related matters by delving into the subsequent sections of this comprehensive guide.

Tips

The IRS 2025: A Comprehensive Guide To Tax Changes And Implications provides valuable guidance for businesses and individuals to prepare for upcoming tax changes. Here are some essential tips to consider:

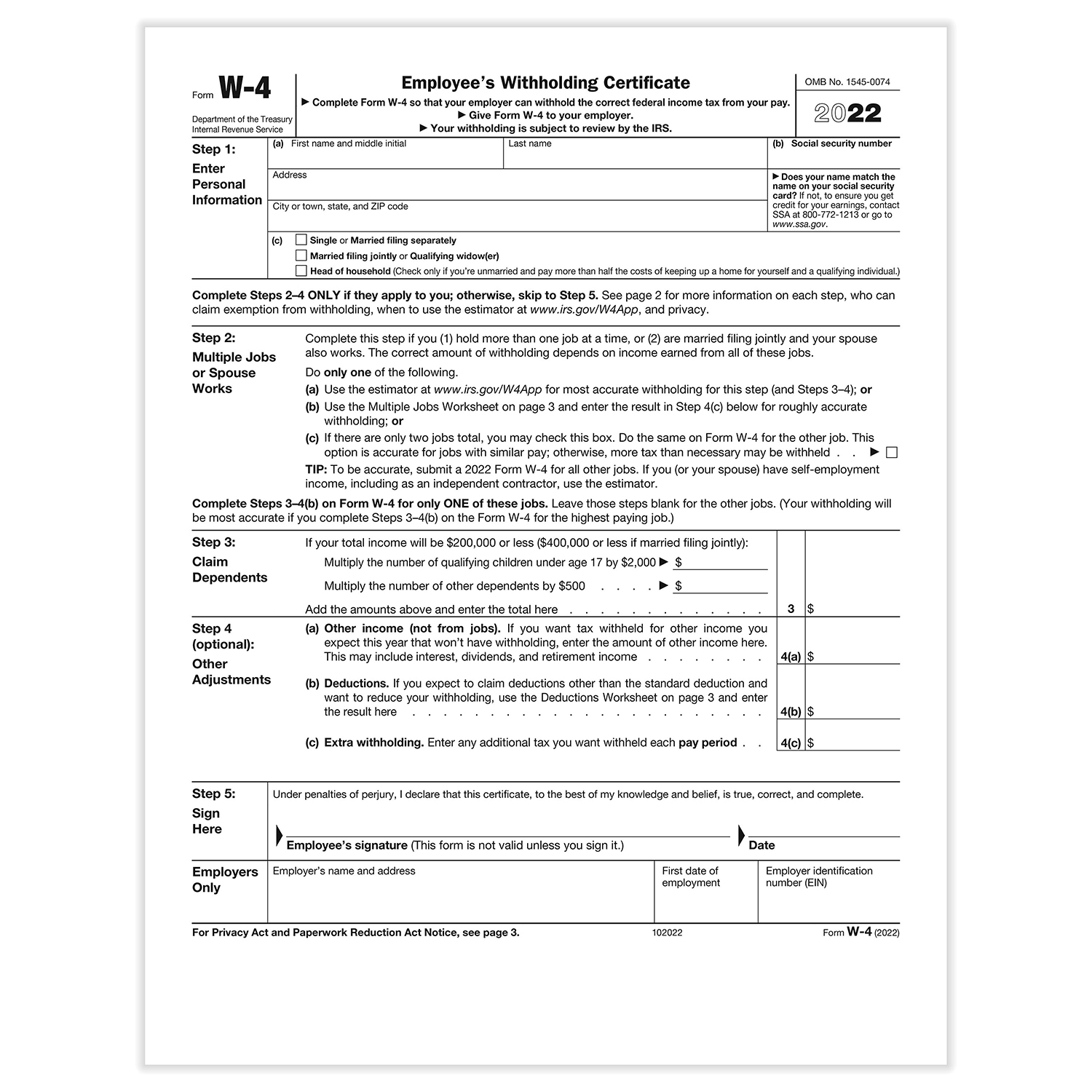

Tip 1: Understand the Changes to Tax Brackets and Deductions

Tax brackets will adjust, affecting the taxable income ranges and corresponding tax rates. Additionally, certain deductions will be phased out or modified, impacting the amount of income subject to taxation. Understanding these changes is crucial for optimizing tax strategies and minimizing liabilities.

Tip 2: Plan for the Elimination of the Personal Exemption

The current personal exemption has been eliminated, which means that a portion of your income that was previously tax-free will now be subject to taxation. This change could have a significant impact on your tax bill, especially if you have a large family. It is important to adjust your withholding or estimated tax payments accordingly.

Tip 3: Consider the Impact of Alternative Minimum Tax (AMT)

The Alternative Minimum Tax (AMT) has been modified to affect more taxpayers. AMT is a parallel tax system that calculates taxes using different rules and a lower exemption amount. If your regular tax liability is below a certain threshold, the AMT may apply, resulting in additional tax liability. Familiarize yourself with the AMT rules to assess your potential exposure.

Tip 4: Maximize Retirement Savings Contributions

Retirement savings accounts, such as 401(k)s and IRAs, offer tax benefits and should be utilized to the fullest extent possible. Contribution limits have increased, providing opportunities to reduce your current tax liability while accumulating funds for future retirement.

Tip 5: Review Tax Credits and Deductions

Various tax credits and deductions are available to reduce your tax burden. Explore the eligibility criteria for these provisions and identify those that apply to your situation. Taking advantage of these deductions and credits can significantly lower your tax liability.

Summary of key takeaways or benefits:

- Optimize tax strategies to minimize liabilities.

- Adjust withholding or estimated tax payments to avoid penalties.

- Maximize retirement savings contributions to reduce current tax burden.

- Review tax credits and deductions to lower tax liability.

Transition to the article's conclusion:

The IRS 2025 changes will have a substantial impact on tax planning and compliance. By understanding the key provisions and incorporating these tips into your strategy, you can navigate the transition smoothly and mitigate the potential financial implications.

IRS 2025: A Comprehensive Guide To Tax Changes And Implications

The Internal Revenue Service (IRS) is implementing significant tax changes by 2025 that will have a far-reaching impact on individuals and businesses. Understanding these changes and their implications is crucial for effective tax planning and compliance.

- Deduction Changes: Modifications to itemized deductions, such as reducing the mortgage interest deduction and eliminating the state and local tax deduction.

- Rate Adjustments: Potential changes to income tax rates, including adjustments to brackets and phase-outs.

- Business Impacts: Effects on business structures, pass-through taxation, and capital gains treatment.

- Retirement Planning: Revisions to retirement account contributions, withdrawal rules, and tax treatment.

- Estate Planning: Updates to estate and gift tax exemptions and rules.

- Technology Advancements: Enhanced use of technology in tax administration, including e-filing and automated audits.

These changes will reshape the tax landscape, affecting tax liability, investment decisions, retirement strategies, and more. It is imperative for taxpayers and tax professionals to stay informed about the evolving IRS 2025 regulations to mitigate potential impacts and optimize tax outcomes.

Irs 2024 Tax Info - Berni Cecilla - Source sianayedeline.pages.dev

IRS 2025: A Comprehensive Guide To Tax Changes And Implications

"IRS 2025: A Comprehensive Guide To Tax Changes And Implications" is a valuable resource for tax professionals and taxpayers alike. It provides a comprehensive overview of the tax changes that have been made in recent years, as well as the implications of these changes for individuals and businesses.

Irs 2025 Forms - Deirdre Nash - Source deirdrenash.pages.dev

The guide is divided into several sections, each of which covers a different aspect of the tax code. The first section provides an overview of the changes that have been made to the individual income tax. These changes include the reduction of the number of tax brackets, the increase in the standard deduction, and the elimination of personal exemptions.

The second section of the guide covers the changes that have been made to the corporate income tax. These changes include the reduction of the corporate tax rate, the elimination of the corporate alternative minimum tax, and the creation of a new deduction for pass-through businesses.

The remaining sections of the guide cover other aspects of the tax code, including estate and gift taxes, excise taxes, and employment taxes. The guide also includes a number of helpful appendices, which provide additional information on specific tax topics.

"IRS 2025: A Comprehensive Guide To Tax Changes And Implications" is an essential resource for anyone who wants to stay up-to-date on the latest tax changes. It is a well-written and comprehensive guide that provides a wealth of information on a complex topic.

- Overview of the Tax Changes

- Changes to the Individual Income Tax

- Changes to the Corporate Income Tax

- Other Changes to the Tax Code

- Appendices

Conclusion

"IRS 2025: A Comprehensive Guide To Tax Changes And Implications" is a valuable resource for anyone who wants to stay up-to-date on the latest tax changes. It is a well-written and comprehensive guide that provides a wealth of information on a complex topic. Tax professionals and taxpayers alike will find this guide to be an indispensable resource.

The tax code is constantly changing, and it can be difficult to keep up with the latest changes. "IRS 2025: A Comprehensive Guide To Tax Changes And Implications" provides a comprehensive overview of the tax changes that have been made in recent years, as well as the implications of these changes for individuals and businesses.